The cryptocurrency market is still struggling to steer away from its current slump. Similar to Bitcoin [BTC] the world’s largest cryptocurrency, Ethereum [ETH] has dropped by 7.81% throughout the week. Shiba Inu [SHIB] endured a double-digit dip of 14.60% and Chainlink [LINK] followed suit with a 12% decrease. But this doesn’t mean this downtrend will continue.

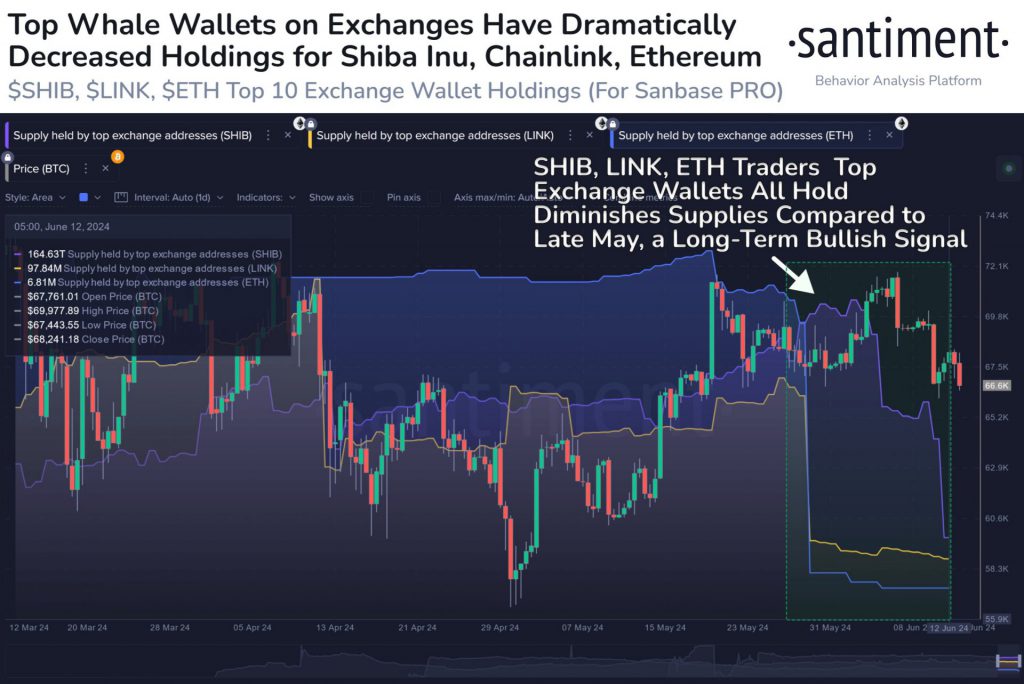

According to Santiment, the holders of the mentioned assets could be gearing up for a celebration. The on-chain analytics platform reveals that the supply that top exchange wallets were holding reduced drastically over the last couple of weeks. Shiba Inu’s supply has plunged by 2.4% since May 27. LINK saw a decline of 2.9% and Ethereum saw the highest drop of 8.6%.

Even though reductions are considered bearish, this one is different. Santiment revealed that a dip in exchange supplies is a bullish signal as traders aren’t focused on selling. The platform wrote,

“Decreasing exchange supplies should be considered a good sign for bullish traders.”

At press time, Shiba Inu was trading at $0.00002157. While Ethereum was trading at $3,516.63 following a slight recovery, LINK was still stuck at $15.30.

Also Read: Shiba Inu: How Much Profit Can Buying the Dip Get You?

Is Shiba Inu’s Future Still Uncertain?

Santiment’s prediction is a good sign. But recent data notes major SHIB holders transferred around 4.29 trillion tokens to Coinbase, a U.S.-based cryptocurrency exchange. The reason behind this sudden yet notable shift is unknown. The relocation could, however, mean that there are chances of sell pressure which could impact the price of the meme coin.

Shiba Inu continues to stay 75% below its all-time high of $0.00008845. Reaching this level is far-fetched but the chances of a bullish rally outshines that of a downtrend.

Also Read: Shiba Inu: Top Analyst Issues Last Buy Call Before SHIB Surges 501%