As the BRICS bloc continues its de-dollarization efforts, Saudi Arabia is reportedly considering the adoption of the petroyuan for oil settlements, thereby ditching the petrodollar. The Minister of Industry for Saudi Arabia has said that the nation is open to trying “new things,” in regards to its cooperation with China.

Riyadh has had a relatively confusing relationship with the BRICS bloc. Although it had initially accepted an invitation to be included in its 2023 expansion, the nation has yet to join. Yet, the country has received an invitation to the Alliance 2024 summit and is seeking an increased relationship with China.

Also Read: How Much Oil Reserves Does Saudi Arabia’s Aramco Hold?

Saudi Arabia ‘Open’ to Oil Settlements in the Chinese Yuan, Official Says

Over the last two years, the BRICS bloc has increased its global position. A key part of that has been its efforts to mitigate reliance on the US dollar. Specifically, the bloc has sought to increase the usage of its own native currencies. Therefore, working to shift the global economic standard away from the West.

Now, discussions are ongoing to place those efforts into overdrive. Indeed, the BRICS bloc could soon see Saudi Arabia embrace a petroyuan for oil settlements, ditching the petrodollar. A new report issued Wednesday noted Saudi Arabian official’s openness to the idea.

Also Read: BRICS Confirms 159 Participants Will Adopt New Payment System

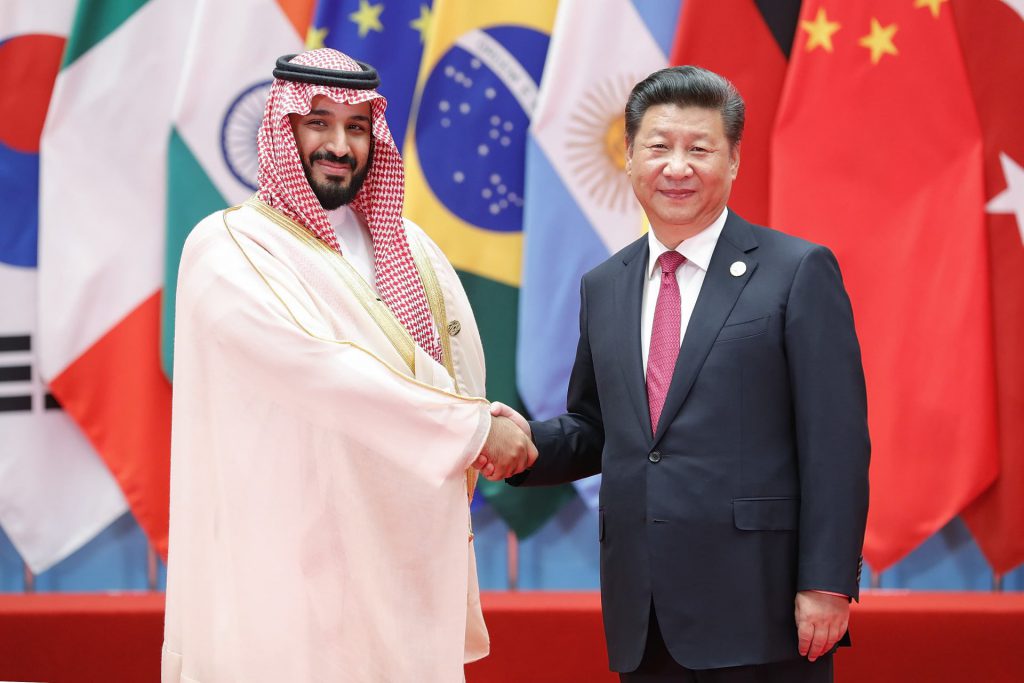

The country’s Minister of Industry, Bandar Al-Khourayef, said they remain “open to new ideas.” That includes increased adoption of the Chinese Yuan. The discussions arrive as the country is looking to embrace Chinese technology, such as eclectic vehicles. The two sides have embraced continued cooperation despite tension between China and the West.

“The petroyuan is not substantial [to the ministry], we believe Saudi Arabia will do what’s in its best interest,” Khorayef said in a recent interview. “But I think Saudi Arabia will always try new things and is open to new ideas, and we try not to mix politics with commerce.”

The decision to abandon the petrodollar would have massive implications. The oil-rich nation would have an undoubted effect on international adoption of the yuan. Moreover, it would continue the decreasing prominence of the greenback on the global stage.