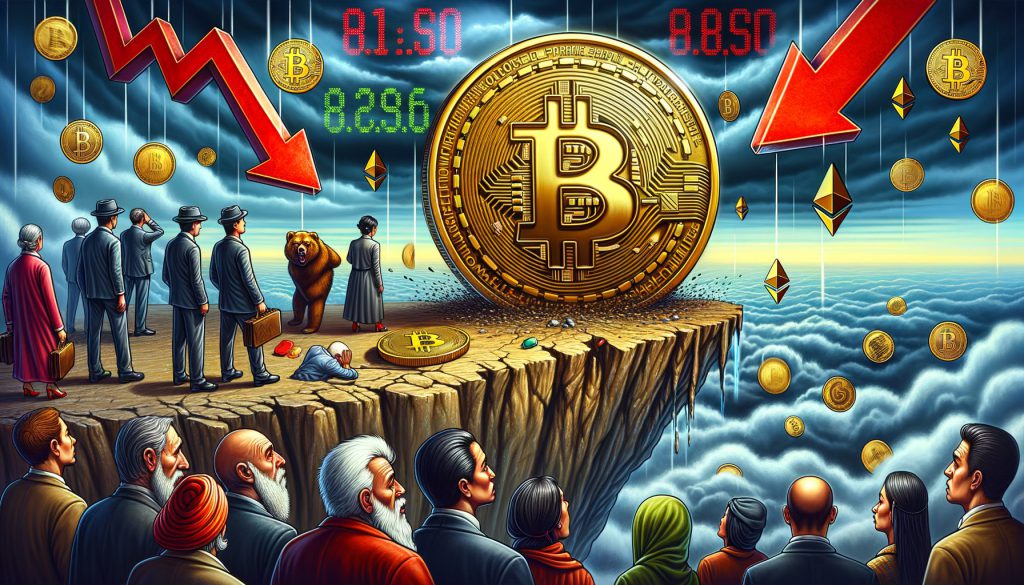

Binance CEO Richard Teng has explained the recent cryptocurrency market downturn, linking the crash to macroeconomic factors.

In a recent X (formerly Twitter) statement, Teng addressed investor and market watcher concerns about sharp declines in crypto and equity prices.

Also Read: Japan’s Stock Market Suffers Worst Losses Since 1987

The Impact of Crypto Crashing on Investors From Binance CEO

Macroeconomic Factors Driving the Crash by CEO of Binance

According to Binance’s CEO, the cryptocurrency market is heavily affected by wider economic trends. Sharp drops in crypto and equity prices are caused by macroeconomic factors, a view many financial experts share.

This link between traditional and digital asset markets is now widely recognized by investors.

Potential for Market Recovery

Even though we’re currently seeing a slump, it doesn’t mean this is a long-term situation. The Binance CEO stressed that the recent crash should not be viewed as a sign of ongoing decline. This outlook may comfort investors shaken by sudden market shifts.

Also Read: $1B Liquidated: Is Now the Time to Buy Shiba Inu (SHIB)?

Fed Rate Cuts and Geopolitical Volatility

Other important elements could lead to market swings. One is the possible Federal Reserve cuts, and the second is the global instability season we’re experiencing.

Investor Concerns and Market Sentiment

As soon as Bitcoin’s value went under $49,000, people were worried. The crypto market’s well-known volatility is again center stage. Investors and amateurs alike are questioning the long-term stability of digital assets. The Binance CEO said that it is vital to stay informed.

Also Read: Ripple: AI Predicts XRP’s Price Post Its Stablecoin Release

Even though there is a current downturn, the Binance CEO believes this isn’t a long-term negative trend. Investors should stay alert and continue building in the space.

As the market evolves, it will be shaped by both macroeconomic factors and the resilience of the cryptocurrency community.