The impending Bitcoin Halving Event set around April 20th, has sparked immense excitement within the cryptocurrency community. This halving, touted as the most anticipated for the network, involves a programmed reduction in miners’ block rewards, slashing them from 6.25 BTC per block to 3.125 BTC. As historical data indicates, such halving events often catalyze significant shifts in the Bitcoin market dynamics, and the forthcoming instance is no different.

A recent report from CoinGecko, a prominent crypto analytics firm, offers a nuanced perspective: while historical trends point to substantial price surges following halving events, there are indications of diminishing returns over time.

Examining past occurrences reveals a striking pattern: Bitcoin has witnessed an average surge of 3,230% following three prior halving events. Such remarkable gains have fueled optimism among enthusiasts, who eagerly anticipate a similar surge this time. However, skeptics, including bears and short traders, urge caution, suggesting that while a price surge is plausible, it may not reach the staggering heights seen in previous halvings.

Also Read: Bitcoin vs Gold: Why Economist Peter Schiff Believes Gold Trumps BTC

Challenges and Factors Influencing Bitcoin’s Future Trajectory

Several factors contribute to this skepticism. Foremost is the impending supply crunch, which presents a significant challenge. With the block reward halved, miners face diminished incentives, potentially leading to a reduction in mining activity. This could exert downward pressure on Bitcoin’s price, countering bullish sentiment.

Additionally, regulatory uncertainties cast a shadow over the cryptocurrency market. Increased regulatory scrutiny, particularly in major economies, could dampen investor sentiment and hinder Bitcoin’s upward momentum.

Economic factors, including inflationary pressures and geopolitical tensions, further complicate the landscape, influencing Bitcoin’s price movements.

Also Read: Cryptocurrency: Three Altcoins Set to Increase 10X Post-Bitcoin Halving

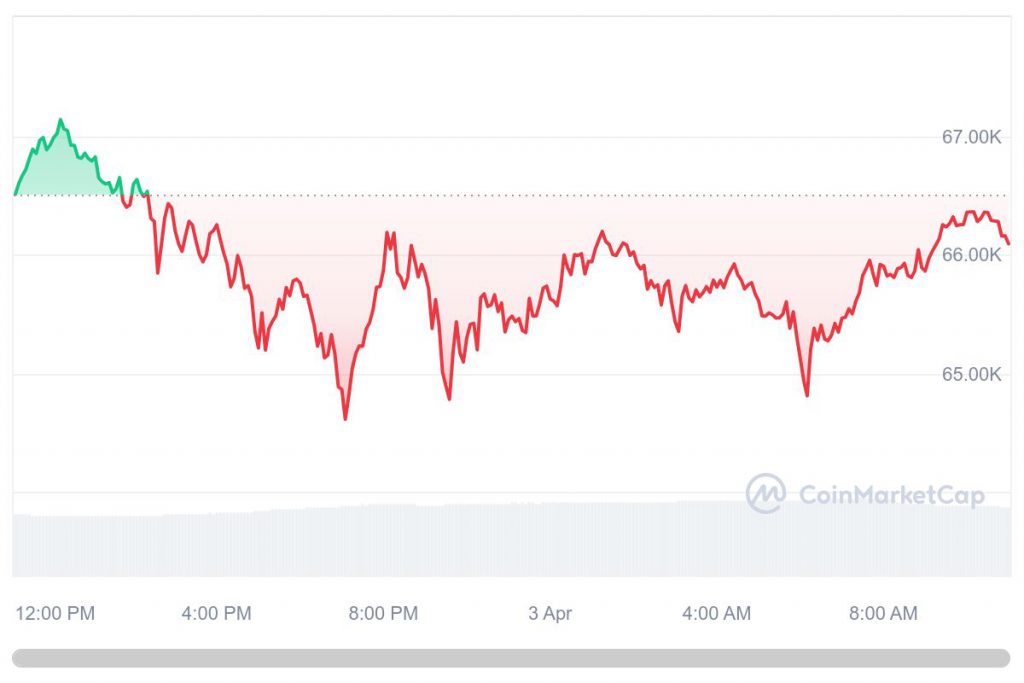

Presently, Bitcoin trades around $66,089.93, demonstrating resilience amid market volatility. However, technical analysis underscores critical support levels that could steer future price movements.

The $63,600 mark acts as a pivotal support level, serving as a safety net against further declines. Maintaining above this level could trigger a bullish reversal, while breaching it may prompt a test of the $47,474 support level.