Canada has stopped its plans for a digital dollar, and the world is surprised about this news. This decision is affecting the world of Central Bank Digital Currency (CBDC). Crypto investors are now wondering how this will change digital currency regulation.

Let’s answer this question, and understand the circumstances better. Scroll down to read more!

Also Read: Commerzbank’s Crypto Move: A Game-Changer for Bitcoin and Ethereum?

Understanding the Impact of Canada’s Digital Dollar Halt on CBDC and Regulation

Bank of Canada’s New Direction

Use

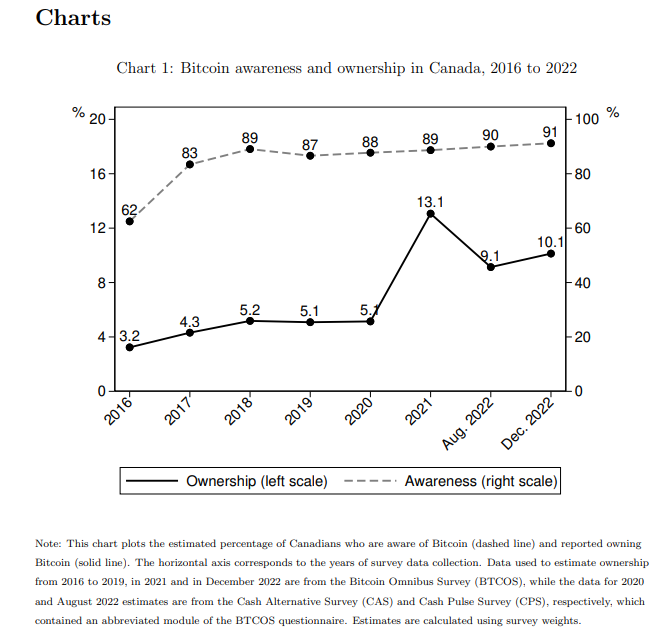

The Bank of Canada started investigating digital currency in 2017 because more people were using digital payments, and fewer were using cash.

Use

But now, after years of study, they’ve decided to stop.

In an email, the bank said:

“The Bank has undertaken significant research towards understanding the implications of a retail central bank digital currency, including exploring the implications of a digital dollar on the economy and financial system, and the technological approaches to providing a digital form of public money that is secure and accessible.”

The bank will now focus on getting ready for future changes in how people pay for things, both in Canada and around the world.

What Other Countries Are Doing

While Canada has paused its digital dollar plans, other countries are moving ahead with CBDCs. The Bahamas, Jamaica, and Nigeria have already launched their own digital currencies.

Also Read: Shiba Inu: ChatGPT Predicts When SHIB Will Rise To 10 Cents

What This Means for Crypto Investors

Canada’s decision could be both good and bad for crypto investors. It might slow down the creation of government digital currencies, which could help existing cryptocurrencies. But it could also mean stricter rules for digital money.

Karl Schamotta from Corpay says:

“One of the things that this cryptocurrency revolution has brought to the forefront is that we need to do more innovation. But at the same time, we also need to preserve safety and many of the features of the monetary system that have been created over centuries and tested out over time.”

Schamotta also thinks there’s no urgent need for a digital Canadian dollar. He believes the central bank wants to stick with the current system because it’s safe and reliable.

Also Read: Buy Reliance Industries (RIL) Shares, Target 3,435: Analyst

Canada’s decision shows it’s tricky to balance new ideas with financial stability. As rules for digital currency change, crypto investors need to stay alert. This pause in Canada’s CBDC plans shows that widespread use of digital currencies might take longer than people thought.