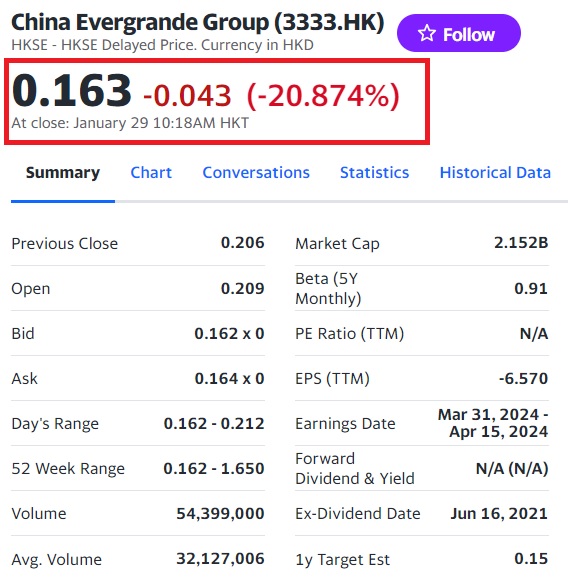

The economic situation in China is alarming as the stock market is looking at a scenario of a possible collapse. Its largest real-estate giant Evergrande has been ordered to liquidate $300 billion in assets by a Hong Kong court. Trading for Evergrande is now halted after it fell like a pack of cards shedding more than 20% a day. The losses are deep after Evergrande’s collapse and that is affecting China’s broader stock market. The Shanghai Stock Exchange (SSE) and Hang Seng Index (HSI) are facing the heat of a possible fall that could be drastic.

Also Read: BRICS Will End U.S. Dollar Dominance, Says Wall Street

China’s stock market entered 2024 on the back foot as it witnessed a significant decline in the charts. The Hong Kong stock markets reached multi-year lows last month causing investors to lose confidence. In addition, foreign capital experienced an exodus with funds exiting the country last month. The development brought down China’s stock market further leading to the Shanghai Stock Exchange and Hang Seng Index losing balance.

Also Read: BRICS To Build ‘Credit Rating Agency’ to Counter US Dominance

On Monday, China’s stock market faced further turbulence as the country’s leading stocks delivered catastrophic performance. If top stocks are unable to hold on to their grip, medium and small stocks could soon face a bloodbath. Therefore, China’s stock market is on the brink of a collapse that could send the prices to dwindle.

China’s Stock Market Did Not React Positively Despite Receiving Help

Keeping the alarming situation into consideration, the China Securities Regulatory Commission (CSRC) committed to preventing abnormal market fluctuations. Despite the assurance, China’s market failed to stabilize and investors’ confidence is at a low.

Also Read: BRICS: No Demand For US Dollar Bonds, Sales Get Worst Start Since 2016

However, investor Jim Rogers assured that CSRC’s intervention could iron out fallacies and stabilize China’s market in the future. “I would suspect that we’re getting near the bottom if we’re not already there because when a government takes strong measures, it usually helps the market,” Rogers said in the interview.