With Intel underperforming over the last several months, can a positive Q3 earnings report help reverse INTC’s ongoing drop? Indeed, the tech company’s stock has struggled to rebound from an underwhelming Q2 earnings report that certainly spooked investors. Now, they hope a different outcome can help reverse course.

The latest earnings report is scheduled to arrive in just ten days. The October 31st records could show a surprise in revenue that leads to renewed interest. Yet, with ongoing discussions regarding the acquisition of Altera and a sale to Qualcomm (QCOM), it doesn’t appear likely.

Also Read: Intel: 4 Reasons Why You Should be Worried About INTC

Intel Q3 Could Make or Break 2024 Performance

Throughout the year, tech stocks have been surging. With demand and interest within the AI sector booming, companies like Nvidia (NVDA) and Microsoft (MSFT) have been flourishing. Yet, that interest has proven to be a negative for some companies that are lagging behind amid the increased competition.

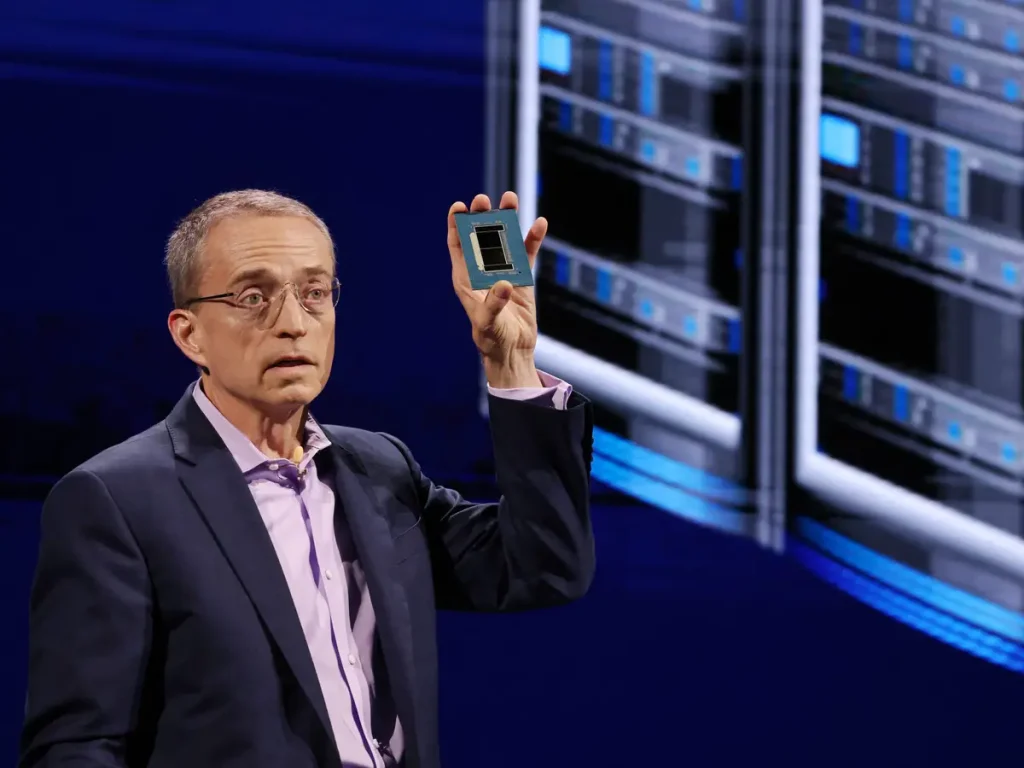

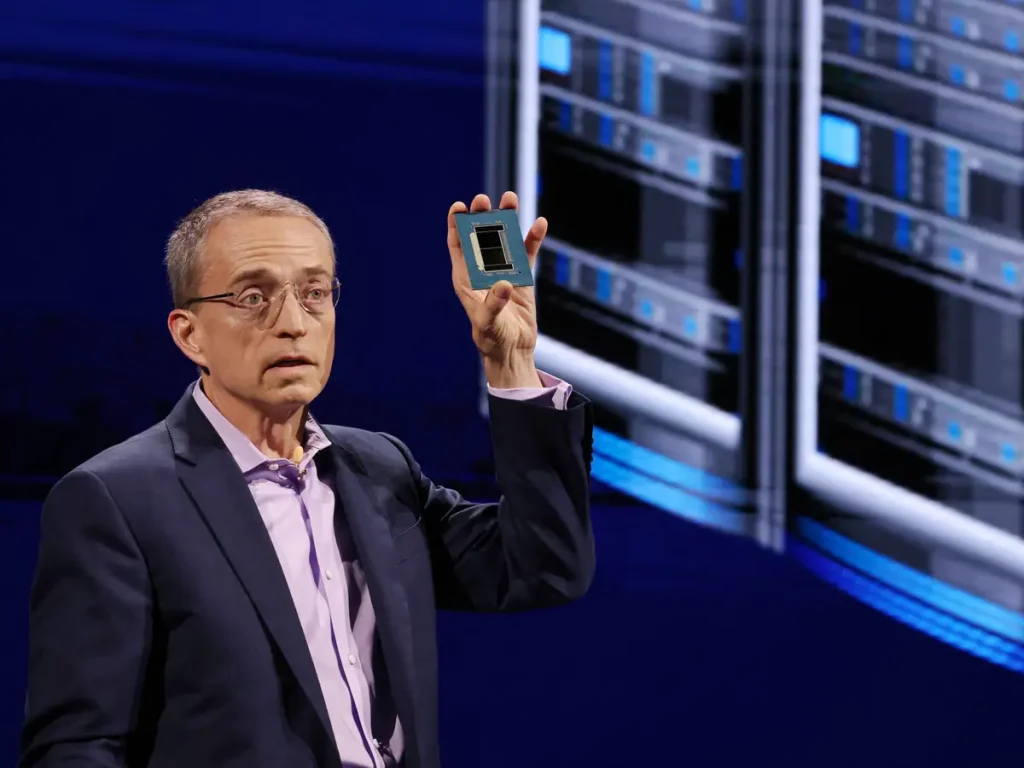

Amogng them is Intel (INTC). After releasing a poor financial report for its Q2 performance, investors have proven weary of the company. That has only raised the stakes for its upcoming record release, as Intel is looking to is Q3 earnings to defend against INTC’s ongoing 55% drop this year.

Also Read: Intel: 30 Analysts Predict INTC to Keep Falling in Next 12 Months

According to a Forbes report, the Q3 2024 results are expected to show a $13.1 billion revenue figure. Moreover, that is set to be down 8% from a year prior but falls in line with expectations. Additionally, they predict a net loss of $0.01 per share. If the actual report shows figures far less than that, INTC could be in for some serious problems.

Although it could be set to drop, the stock has been volatile for the last four years. In 2021, the return for the stock reached 6%, plummeting to -47% a year later, before reaching 95% in 2023. That could lead many to believe that inconsistency is just the reality of the tech company. Yet, at some point, a trend is likely to emerge. The question is, can Q3 save that from being a negative one?