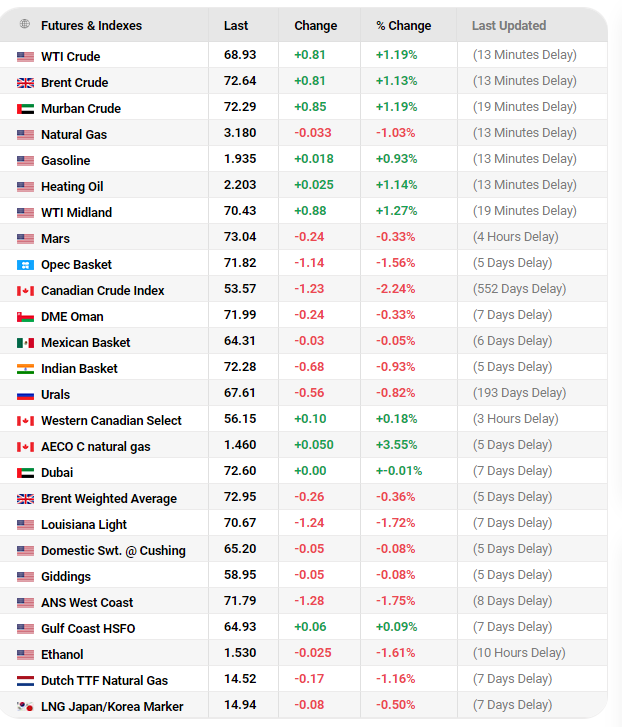

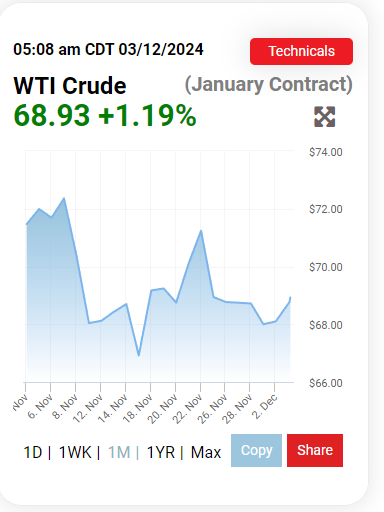

Oil prices are staying steady as global oil markets watch closely. Brent crude sits at $72 per barrel within a tight oil range. OPEC+ will meet soon to discuss production, while global tensions and changing demand shape the market picture. Recent events in the Middle East and economic signals from major economies add extra weight to upcoming decisions.

Also Read: Trump’s SEC Chair Selection: Prediction Markets Signal Major Regulatory Changes

Understanding the Impact of OPEC+ Policies On Oil Prices & Global Economy

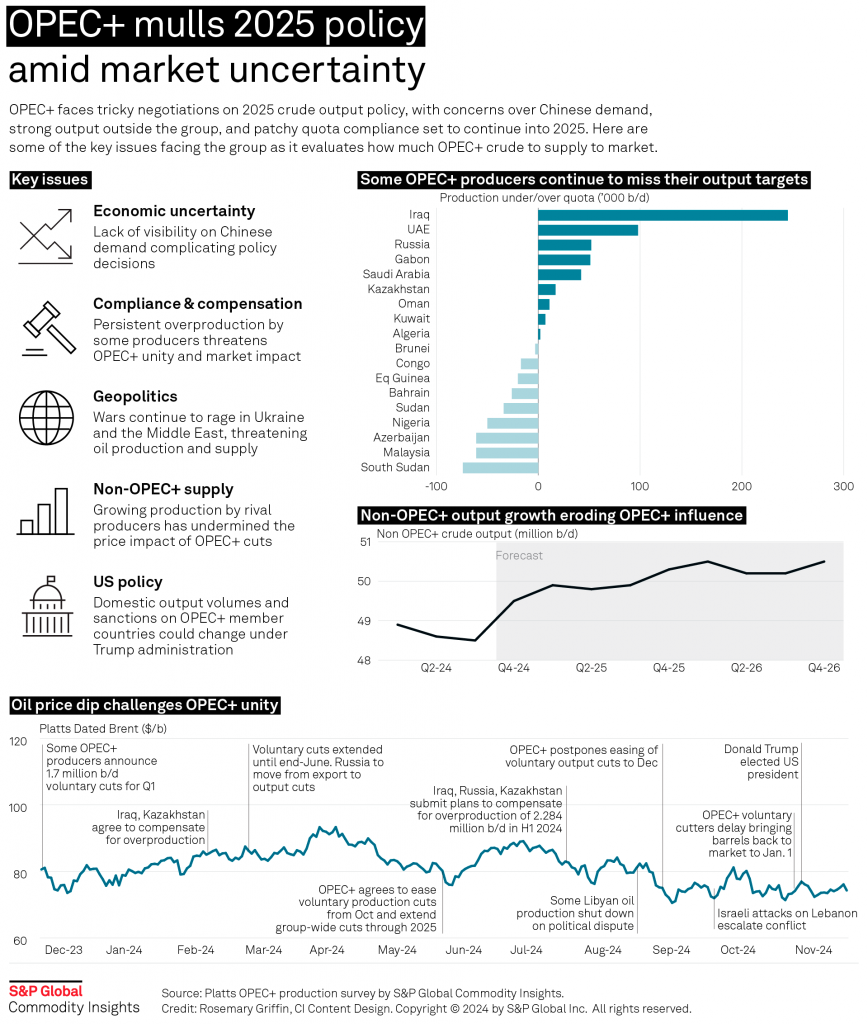

The global oil market faces a unique moment. OPEC+ leads the way in managing supply and demand. Current oil prices show their strategy is working, keeping values stable despite market pressures. Market watchers note that this stability comes during unusually challenging times.

Current Market Dynamics

Oil market trends show prices in a tight oil range of just $6 since mid-October. This steady pattern in the global oil market continues even with Middle East tensions and shifting buyer habits. Trading volumes suggest market participants are comfortable with current price levels.

Also Read: Shiba Inu: You Could Have Made $103 Million With Just $1000

Key Market Influences

Three main factors affect oil prices today:

- China’s Next Steps China plans its economic future next week. As the biggest oil buyer, their choices will affect oil market trends worldwide. Their stimulus plans could change how much oil they need. Recent data shows China’s demand patterns are already shifting in response to economic changes.

- OPEC+ Plans Thursday’s OPEC+ meeting matters a lot for oil prices. Most think they’ll keep output low because they worry about having too much oil next year. Previous decisions have shown the group’s commitment to market stability.

- Weather Effects Cold weather in Europe means more need for heating oil. This helps keep oil prices stable and shows how seasons affect oil demand. Current temperature forecasts suggest this support could continue through winter.

Market Implications

Oil prices are so stable that market worry measures are at two-month lows. Traders seem content to wait for OPEC+ decisions and economic news before making big moves. Market data shows historically low volatility levels across major oil benchmarks.

Also Read: Ripple (XRP) & Dogecoin (DOGE) Price Prediction For Mid-December 2024

Future Outlook

The global oil market watches OPEC+ closely. The group likely won’t change its careful approach to production. This helps protect oil prices while keeping buyers and sellers happy. Analysts expect this balance to continue into early 2024, barring major global events.