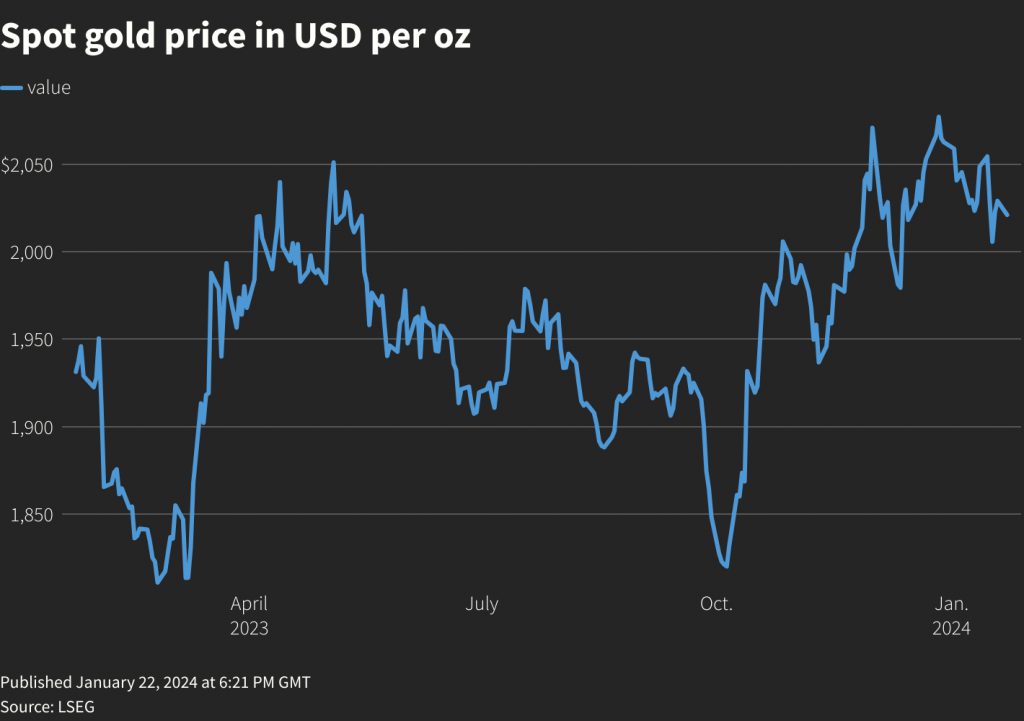

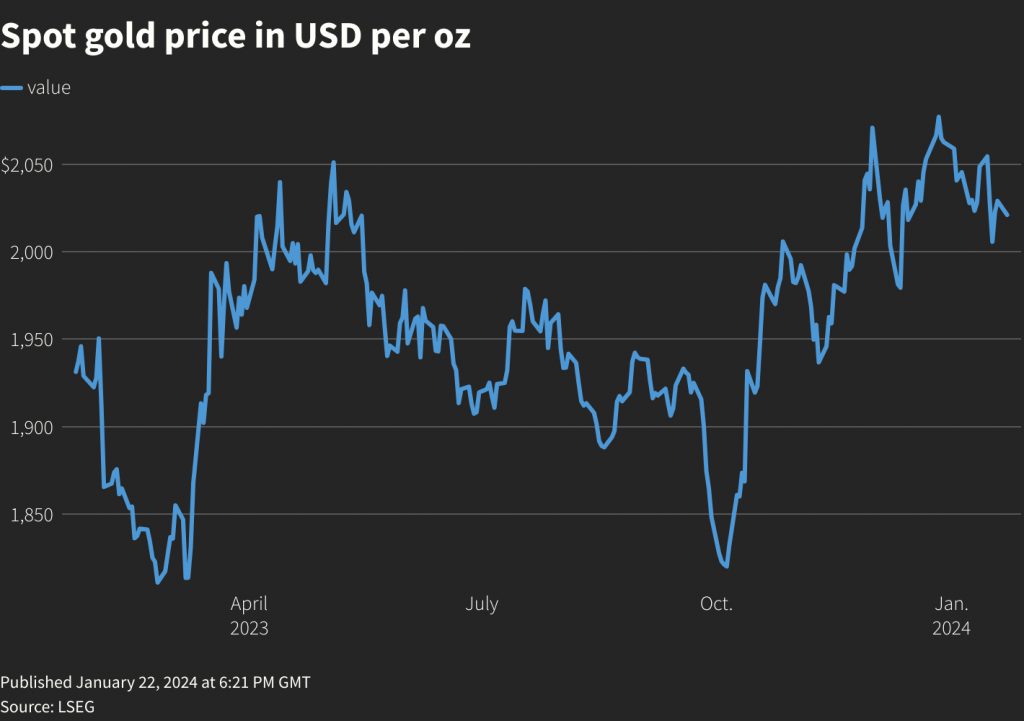

US Gold prices dipped on Monday as investors lowered their expectations of interest rate cuts by the end of March 2024. Spot gold prices fell 0.5% to $2,020.09 per ounce at 1:49 p.m. ET. On the other hand, the futures price for the yellow metal went 0.3% lower at $2022.2.

Also Read: Gold (XAU/USD) Prices See Small Rebound As Price Climbs Above $2020

On the other hand, spot silver fell 2.1% to $22.13 per ounce. Platinum dropped 0.7% to $892.89, while palladium dipped by 1% to $936.69.

Why is gold slipping?

According to Jim Wyckoff, senior analyst at Kitco Metals, two factors are halting interest in gold and silver markets. According to Wyckoff, technical selling and a rally in stock markets are taking investor attention away from the precious metals. Wyckoff stated, ‘We have had better US economic data lately that suggests the Fed may have to hold off longer on lowering interest rates.‘

Higher interest rates may increase the opportunity cost of holding precious metals. Gold prices fell around 1% last week, the most significant weekly decline in six weeks. The dip followed the US Federal Reserve’s statement that it needs more inflation data before any rate cut judgment. Moreover, the Fed stated that the baseline for rate cuts was in the third quarter of this year.

Also Read: Gold Price Drops Below $2050, How Will Price Perform In 2024?

According to the CME Fed Watch Tool, there is a 41.6% chance that the Federal Reserve will cut interest rates in March. Last week, traders priced in a 70% chance of a rate cut in March.

Investors and traders are eyeing the US flash PMI report on Wednesday, the fourth-quarter advance GDP estimates due Thursday, and personal consumption expenditures data on Friday. The data could give a clue about the next move by the Federal Reserve.