XRP’s recent price moves have caught attention. Its bull rally and consolidation phase have ended, leading to experts’ new crypto forecasts.

Let’s dive right in and find out more about this topic!

Also Read: Dogecoin’s Network Activity Soars: Can DOGE Hit 20 Cents Soon?

XRP’s Bull Rally: Understanding Consolidation And Market Forecasts

Breaking Out of Consolidation

XRP ended its two-week consolidation on October 15, 2024. It jumped 3.6% in 24 hours, and trading volume increased by 90%. This shows that more investors are becoming interested.

Technical Analysis Looks Positive

XRP’s technical indicators look good. It’s testing the 200-day Exponential Moving Average. Breaking this level could lead to more gains, which could start a longer bull rally.

Also Read: BRICS Advances ‘Multicurrency System’ To Break US Dollar Dominance

On-Chain Data Supports Bullish View

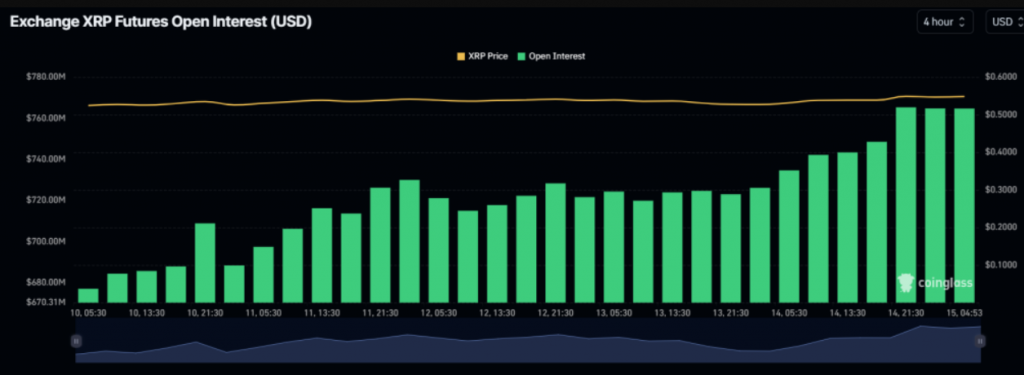

On-chain data backs up a positive outlook for XRP. The Long/Short ratio is 1.039. This means more traders think prices will go up. Futures open interest also rose 9.5% in one day.

Price Targets and Predictions

Analysts think Ripple’s coin could hit $0.65 soon. This crypto forecast is based on current trends and technical analysis. But Ripple’s coin must first close above $0.5580 on the daily chart. Traders are closely watching the ongoing XRP consolidation.

What’s Driving XRP’s Momentum

Several factors are pushing Ripple’s coin’s price up. A Spot ETF filing in the U.S. has caught the attention of big investors. This and recent price jumps have created good conditions for XRP’s potential bull rally.

Market Outlook

The crypto market is watching XRP closely. The next few days are crucial. They’ll show whether Ripple’s coin can keep its momentum and reach the expected $0.75 mark, which would be a big step in XRP’s bull rally.

Also Read: Sell Jio Financial Shares: Enter at 320 Price Level

Current market conditions and technical signs point to a good outlook for XRP. But all crypto forecasts come with risks. While the end of Ripple’s coin consolidation is exciting for investors, the long-term effects are still unknown.