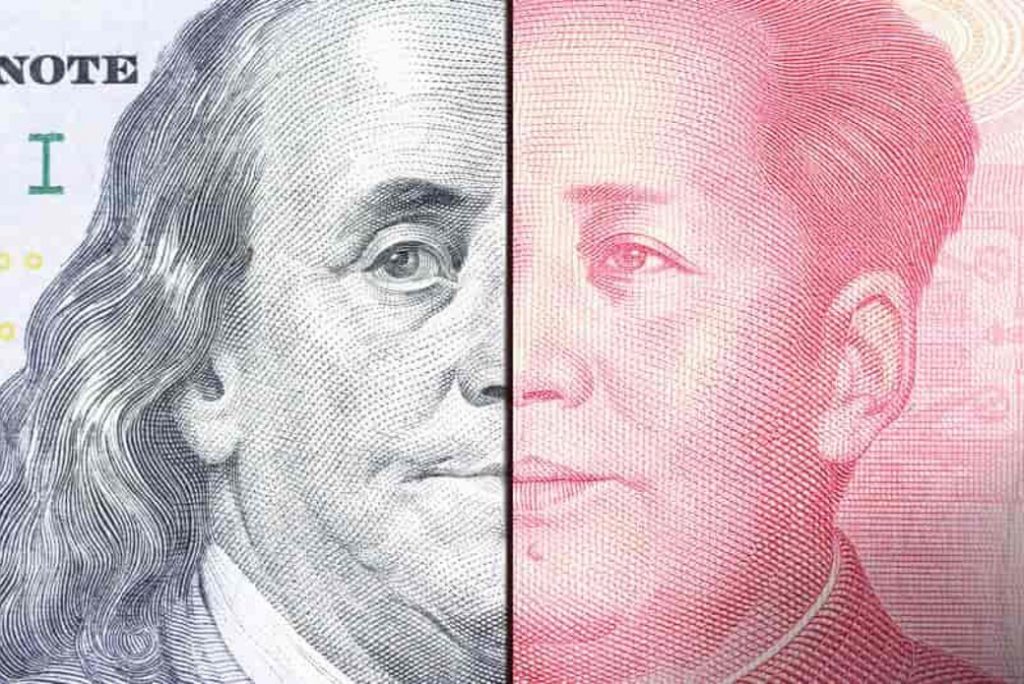

The Chinese yuan is the rising star of the world financial market, emerging as a competent contender to the US dollar. The inflating US debt metrics and its constant weaponization have paved the way for the regional currencies to surge high on the radar, with the Chinese Yuan taking the front lead. But will it ever be able to derail the US dollar in the long haul? Let’s explore the possibilities.

Also Read: Bitcoin Surges Past $64K: Is $90K the Next Target?

Chinese Yuan vs US Dollar: What Makes Yuan More Alluring And Tempting

The Chinese Yuan is rising rapidly on the global radar. The recent petrodollar collapse has also given birth to a new phenomenon: the Petroyuan. Saudi Arabia is open to dialogue to explore the development above.

At the same time, the Saudi administration’s official statements also revealed their keenness to buy petrol in other currencies, notably Yuan, promoting the Chinese currency to change the world’s financial dynamics.

“The petroyuan is not substantial to [the ministry], and we believe Saudi Arabia will do what’s in its best interest… But I think Saudi Arabia will always try new things and is open to new ideas, and we try not to mix politics with commerce,” Bandar Al Khorayef said in an interview on Saturday in Hong Kong.

This development paved the way for China to internationalize the Yuan, a strategic process that aims to integrate the Yuan as the central currency for the world’s transacting.

In addition, the Chinese internationalization of the yuan has already found its footing in Russia, where it has become one of the core transactional currencies. Russia has long been using the Chinese Yuan to evade US sanctions, bolstering its use cases.

Also Read: This Memecoin Rallied 3600%: Outshines Shiba Inu & Dogecoin

In addition, the rapid progress noted in the Chinese economy is also ushering in a wave of change for the yuan. The Yuan has hit a 16-month high against the US dollar, further strengthening it to new levels.

Chinese stocks have also soared to new highs after its central bank decided to cut rates by 50 bps.

Will Yuan Ever Be Able To Subdue The USD?

China is also active in BRICS, a ten-boss alliance working against the US dollar. The bloc is developing a payment system to derail the US dollar and subdue its global power.

While the inflating US debt metrics weaponization has urged several countries to pivot from the US dollar, dominating the US dollar would be a difficult task. For instance, USD is still a favoured choice of central banks worldwide and global trade financing. It will take much more effort for the yuan or any currency to topple the US dollar in such sectional dynamics.

Also Read: When Will Jio Financial Shares Reach a Price Target of 400?

“Predictions of the dollar’s demise may be greatly exaggerated,” says James Lord, Morgan Stanley’s Head of Foreign Exchange Strategy for Emerging Markets. “It has the potential for cyclical decline if and when the Fed cuts interest rates but will still be bolstered by its enduring dominance as a reserve currency. It’s still the favored choice for central bank allocations, global trade financing, foreign exchange activity, cross-border lending, and debt issuances.”